Invest in ETFs: Your Ultimate Guide for 2023

In the ever-evolving landscape of investment opportunities, Exchange-Traded Funds (ETFs) have gained significant popularity among investors of all levels. If you’re looking to make the most of your investments in 2023 and beyond, understanding how to invest in ETFs is crucial. This comprehensive guide will take you through the ins and outs of Invest in ETFs, helping you make informed decisions and navigate the financial markets with confidence.

What Are ETFs?

Before we dive into the nitty-gritty of investing in ETFs, let’s start with the basics. An ETF is a type of investment fund and exchange-traded product with shares that are tradable on a stock exchange, similar to individual stocks. ETFs are designed to track the performance of a specific index, commodity, bond, or a basket of assets.

Why Invest in ETFs?

Diversification: One of the primary reasons investors choose ETFs is their ability to provide diversification. When you invest in an ETF, you gain exposure to a wide range of assets, reducing the risk associated with individual stocks or bonds.

Liquidity: ETFs are traded on stock exchanges throughout the trading day, offering high liquidity. This means you can buy and sell shares of an ETF as easily as you would with a stock.

Lower Costs: ETFs are known for their cost-effectiveness. They typically have lower expense ratios compared to mutual funds, making them an attractive choice for cost-conscious investors.

Transparency: ETFs offer transparency in terms of their holdings. You can easily find information about the assets held by an ETF, enabling you to make informed investment decisions.

Types of ETFs

Investing in ETFs provides access to a wide variety of asset classes and investment strategies. Here are some common types of ETFs you might consider:

- Equity ETFs: These ETFs track stock market indices and provide exposure to a specific segment of the equity market, such as technology, healthcare, or emerging markets.

- Bond ETFs: Bond ETFs invest in a portfolio of bonds, offering investors a convenient way to access fixed-income securities with varying maturities and credit qualities.

- Commodity ETFs: Commodity ETFs track the prices of commodities like gold, oil, or agricultural products, allowing investors to gain exposure to the commodities market without physically owning the assets.

- Sector ETFs: Sector-specific ETFs focus on specific industries or sectors of the economy, such as financials, healthcare, or energy.

- International ETFs: These ETFs provide exposure to foreign markets and allow investors to diversify their portfolios globally.

- Inverse ETFs: Inverse ETFs aim to profit from the decline in the value of an underlying index or asset. They can be used for hedging or as a way to profit from market downturns.

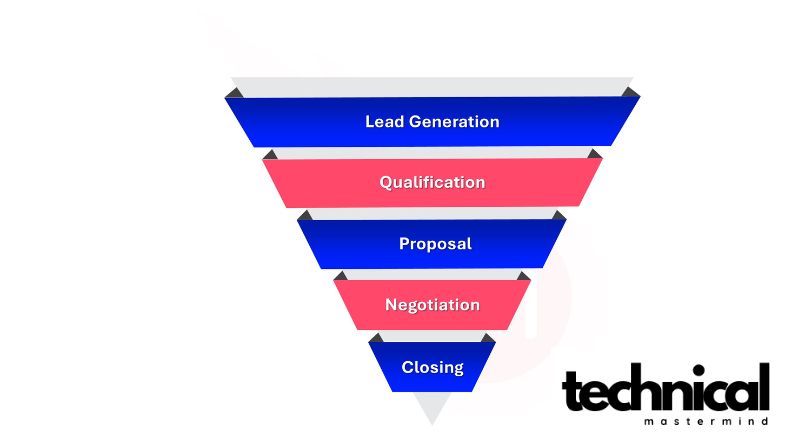

How to Invest in ETFs

Investing in ETFs is relatively straightforward. Here’s a step-by-step guide to get you started:

Step 1: Choose a Brokerage Account

To invest in ETFs, you’ll need a brokerage account. Research and select a reputable online brokerage that suits your needs in terms of fees, available ETFs, and user interface.

Step 2: Fund Your Account

After opening your brokerage account, you’ll need to fund it. You can transfer funds from your bank account to your brokerage account to have capital available for investing.

Step 3: Research ETFs

Before making any investments, conduct thorough research on the ETFs you’re interested in. Consider factors like the ETF’s expense ratio, performance history, and the underlying assets it tracks.

Step 4: Place Your Order

Once you’ve identified the ETFs you want to invest in, place your order through your brokerage account. You can specify the number of shares you wish to purchase and the price at which you want to buy.

Step 5: Monitor Your Investments

After investing in ETFs, it’s essential to monitor your portfolio regularly. Keep an eye on market conditions, news, and any changes in your investment goals to ensure your portfolio remains aligned with your objectives.

Tips for Successful ETF Investing

- Diversify: Consider diversifying your ETF investments across different asset classes and sectors to spread risk.

- Reinvest Dividends: If your ETFs pay dividends, consider reinvesting them to take advantage of compounding returns.

- Stay Informed: Keep yourself updated on market trends, economic news, and any developments that could impact your ETF investments.

Conclusion

Investing in ETFs can be a powerful strategy to achieve your financial goals in 2023 and beyond. With their versatility, low costs, and liquidity, ETFs offer a practical way for both novice and experienced investors to build diversified portfolios. By following the steps outlined in this ultimate guide and staying informed about your investments, you can make the most of the opportunities that ETFs present in the ever-changing world of finance. Remember, the key to successful investing is knowledge, patience, and a long-term perspective. Happy investing!

Post Comment